Compartir en

With the promotion regime for the hotel sector, the City -through investBA and the Tourism Entity- allows you to access tax incentives for the construction, remodeling and / or expansion of hotels in Buenos Aires. Learn about the current regulations, what they are and how to apply for tax benefits!

What are the benefits for the construction of new hotels?

-

Businesses that develop new hotel facilities are eligible to apply for benefits of up to 50% of the investment to be made, in the form of tax credit applicable against gross income tax. Any credit balance may be carried forward and applied against tax liability for a term of 15 years or until said tax credit is applied in full, whichever happens first (for projects submitted before 31 Dec 2021*). In the highest benefit range, the bill offers beneficial treatment for small or middle-sized enterprises undergoing construction of new facilities, or for projects with specific features such as their location within strategic neighborhoods on the City of Buenos Aires, or their choice to revamp and invest in buildings protected under the City’s heritage laws.

-

Furthermore, all businesses building new hotel facilities will be eligible for ABL (property-related) tax payment deferral until completion of construction works. If all other requirements are met and the hotel is granted final license to operate, said business will be eligible for ABL-exemption.

.jpg)

How is the application process?

.jpg)

.jpg)

What are the benefits for remodeling and / or expanding hotels?

-

Hotel businesses who remodel, expand or introduce improvements to their facilities will be eligible to apply for a benefit of up to 60% of the expended investment in the form tax credit applicable against income tax obligations. In these cases, the bill stipulates a maximum term of 3 years for completion of works, with tax-credit carryforward for 10 years or until said tax credit is applied in full, whichever happens first.

-

In the highest benefit range, the bill offers preferential treatment to small and middle-sized enterprises and projects with features such as the choice to revamp and invest in buildings protected by the City’s cultural heritage laws.

.jpg)

Which are the tax relief measures for the Covid-19 pandemic?

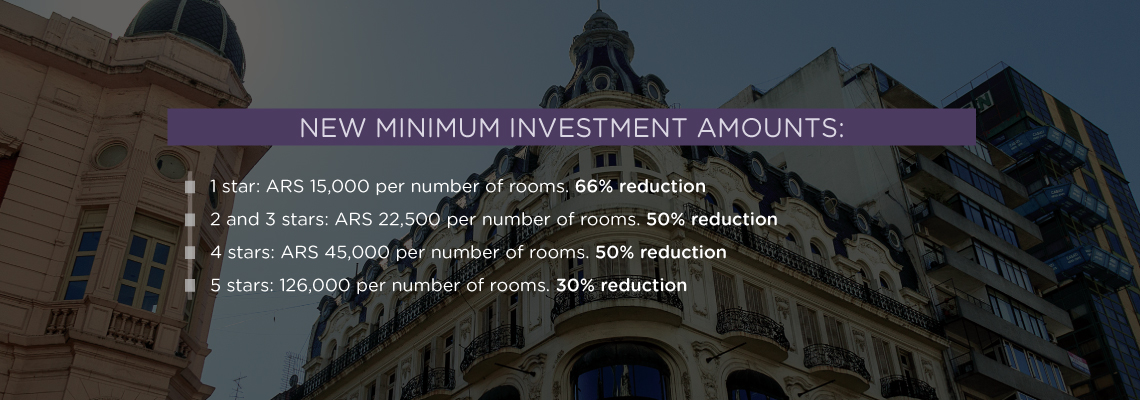

Aware of the needs of the sector, the City issued a resolution to reduce the previously established minimum investment amounts between 30% and 66% depending on the hotel category.

In addition, the monthly payment of the ABL tax remains without effect during the period of April to September.

How is the application process for remodeling existing hotels?

.jpg)

.jpg)

.jpg)

Want to know more?

Download this presentation and access all the information on the tax incentives regime for the construction, remodeling and / or expansion of hotels in the City of Buenos Aires. You can also contact us at investba@buenosaires.gob.ar to meet with an expert and receive personalized advice.

Rules and regulations in force: